Effective Living > Transportation | Technology

Summary. Progressive offers auto insurance discounts based on an analysis of your driving habits over a thirty-day period.

Summary. Progressive offers auto insurance discounts based on an analysis of your driving habits over a thirty-day period.

To do this, they use a small transmitter device (SnapShot) that plugs into your cars computer interface.

The car’s computer provides the SnapShot transmitter with date, time, speed, and other information about your car’s operation.

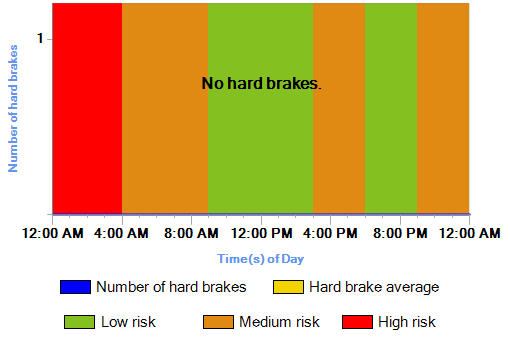

A few factors are considered when evaluating your eligibility for a discount of your existing insurance premium. The primary consideration is the time of day you regularly drive your car and also the number of “hard break” instances you have. Any decrease in your speed of 7 miles per hour in a second is considered a “hard break” event. These are indicators that you might not be paying close enough attention to your surroundings, or you may be following too close to the car in front of you.

Shortcomings. The SnapShot program has a few shortcomings.

- Cheaters. It would be possible to cheat the system by participating in the program, but intentionally taking road trips on highways known to reduce the number of hard break conditions, and only driving the car during low risk times of day.

- Dual Drivers. The 30-day assessment may only be based on one of two insured drivers. If the driving is primarily done by the more cautious driver, or the driver that only uses the car for off-peak driving, then the insurance rate will be decreased, yet the liability of the unknown second driver’s habits remains.

- Public Transit. The program makes drivers aware of the time of day analysis being made. Those wanting to avoid driving in medium risk times of day may take public transit during the 30-day assessment period.

- Safety. There are a number of circumstances when driving to achieve the best score could easily produce unsafe conditions. For example, you are driving the speed limit, and as you approach an intersection, the light turns yellow. Deciding to play it safe, you apply the breaks and bring your car to a controlled stop. The SnapShot device will often interpret this as an unsafe maneuver or condition. To avoid getting docked a point for a “hard break” you would need to drive through the intersection as the light is turning from yellow to red. Similar circumstances beyond your control would dictate that you drive safely by breaking quickly as needed for erratic pedestrians, bicyclists, or animals in the road. All of these safe maneuvers would be considered unsafe by the SnapShot device.

- Seasonal Driving. Some people change their driving patterns by season, driving less when the weather is nice (for example). If the 30-day assessment occurs during a time of good weather, and the driver chooses to ride a bicycle during the assessment period for medium and high risk periods, the insurance will drop despite later changes in driving habits.

- Vacation. If the 30-day assessment includes a week or more of vacation time, this may create an inaccurate picture of driving conditions by reflecting little or no driving because vacationers rented a car, chose air travel, or some other means of transportation. If someone happens to be driving on their vacation, then driving times may occur in high risk times of the day which would otherwise be not typical for that vehicle.

- Work Schedules. Some people have jobs that require changes in work schedule. One month they may work the day shift, and then next month they may work a night shift. If the 30-day assessment occurs during a time when low risk driving is prevalent, then the insurance rate may be lowered even though the car will be regularly used during high risk times later.

Future Technology. Despite the above shortcomings, the SnapShot technology offers very valuable data about vehicle usage, and also gives drivers an incentive to drive more carefully and choose lower risk times of the day to use their car. It’s likely that future technology will come preinstalled in cars and be used more universally by more insurance companies. Additional data could be gathered using GPS technology to tell the insurance company where you are driving and how fast you are driving in comparison to speed limits. Presumably insurance rates could be changed in real-time as you drive. You could program your GPS to take you on the most insurance friendly (and safest) route. Having cameras and microphones in the car could monitor a variety of conditions including driver alertness, interior conditions, exterior surroundings, weather, and use of electronic devices while driving — which are all factors that influence safety. As a driver starts texting while driving, they could be charged a small fee to compensate for the additional risk while they are texting. A display on the dashboard could show you your current insurance rate per minute or per mile based on current location, speed, road conditions, weather, and driver behavior. The possibilities are endless. However, people’s concern about privacy may limit this technology from being adopted.

Commentary. The following is a commentary by transportation consultant Gregory Johnson.

“I think the Progressive SnapShot device has made me a better driver. I find I’m choosing to run errands during low risk times of day, and I’m very careful to maintain driving habits that will create conditions for gradual breaking. In today’s society of real-time updates via Facebook and Twitter where people are sharing their location and activities throughout the day, I think privacy concerns are less of an issue.” ~ Gregory Johnson